Chaos Clinic Recap

Here are Al's comments

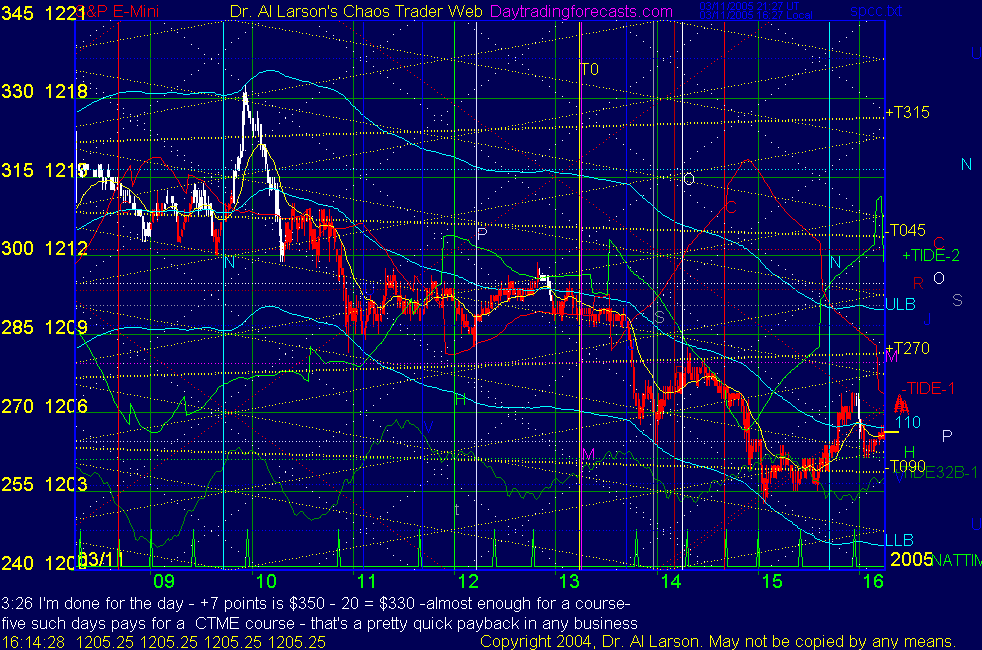

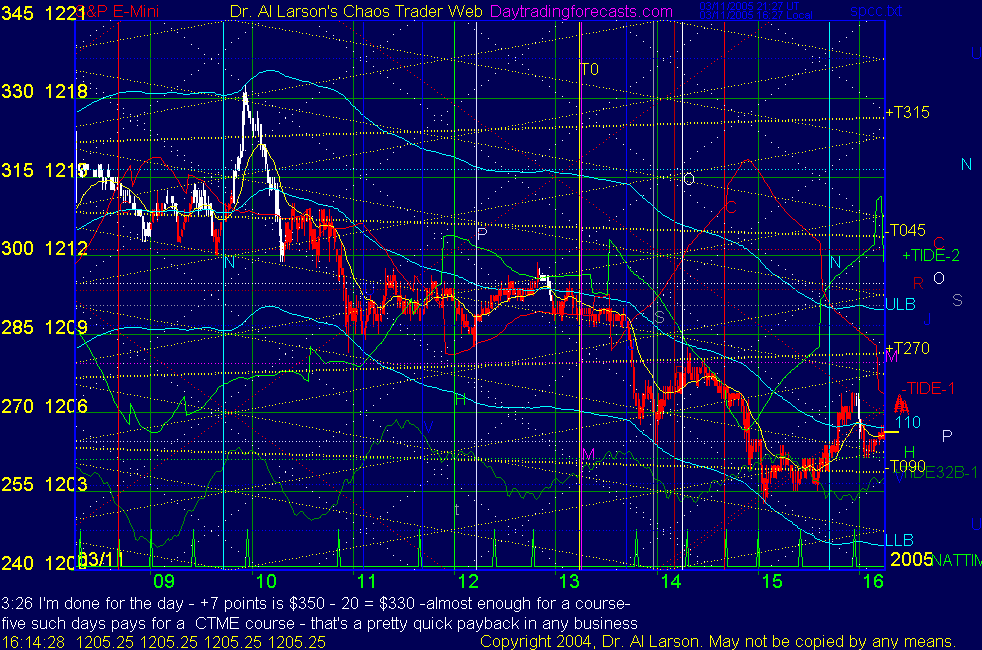

3:26 I'm done for the day - +7 points is $350 - 20 = $330 -almost enough for a course-

five such days pays for a CTME course - that's a pretty quick payback in any business

3:11 OK, taking taking my +4.5 - hit the lower band

3:01 stop 1206; 1200 is possible - CTME says down into close so I'll just hold

2:55 stop 1207 -the bulls have capitulated-yeah chaos

2:49 stop 1208-I'll just wait

2:35 I'm just holding -here the 110 EXMA is still down-and I have a good fit with a

Fractal of Pi pattern, and the CTME fractal grid says to hold short

2:28 if the next trade time sets up a continuation sell, I'll just hold

2:20 testing the 110 EXMA-acts like a tongue depressor

2:13 the stable hex at 1210 has now been lost, so a move of 6 or 12 points is possible-1204, 1198

2:08 stop 1209 -need to be patient

1:56 the CTME tools told be to jump on any break of 1209 - I kept argueing for the red -Tide,

but gave up my vanity and pride and went with Crazy Harry, the conductor of the S&P train

1:50 stop 1210 -fast break-press hard-this streak is part of the Chaos Grid from the CTME course

1:44 continutations sell-sold 8.5 stop 11.5

1:33 -still dead-if on red -Tide that should change soon

1:16 so far best fit is with red -Tide-watching for some energy at this Tide turn

1:07 slow crawl up from early low - looks like bulls trying to get a rally going

12:53 coming to the Moon timeline-may get a little energy as we pass it-

12:45 stuck midway between the -T045 and +T270 Moon flux-a congestion trap- aided by Mars/Node/Saturn

12:31 getting enough lift to curl the 110 EXMA upward a bit-means that the down energy is waning

12:15 does not look like much, but may be important-last dip was a higher low

12:05 little drop as we pass the Sun, part of that hex - I'm watching to see if we make 1208 Mer/Moon

11:58 one of the hardest things about trading chaotic markets is taking the hours of boredowm

interspersed with moments of sheer excitement - chaos trading is about finding the streaks of excitement

11:41 on the opening I said it might be an "I'm exhasted" day - the bulls got whacked, the bears

got stopped a a higher low re. yesterday

11:35 really stuck on that Saturn flux line as per the hex recognizer

11:23 looks like for now we have picked up the green +Tide

11:13 a hex pattern indicates a harmonic condition-often a stable price

11:05 now we have a hex pattern recognized - Sun, Saturn, Mars -see hex wheels page

10:58 now we have hit the lowerband edge-very close to the email 1208 very hot Mercury/Moon price

10:54 I did mis-execute that trade-an out of band trade should be covered at +4, which was hit

it's awful hard to teach and trade :)

10:51 sometimes you will cover, then the market will move -that's OK-more trades will come later

10:47 this is particularly true on a trading range day like today - the early bulls got spanked,

but not hard enough to build a trend-in a good trend you do not see 30 minute pauses-hence my stall rule

10:42 Chaos is like a thunderstorm - when the wind and rain stop, cash it it

10:39 I am going to cover this trade on the stall rule for +2.5

10:38 Certified Chaos Traders now can check their private room to see how I've set up my CTME chart

10:30 stop 1215-lock in 1 point and wait

10:27 now I have set up the fractal grid on my esignal chart- it gives me information about the

daily fractal - this tool is unique to the CTME course

10:18 another thing that helped me there was my CTME chart with 3 minute bars on ESignal

it told me that high was a sell point- a full set of Chaos Trading Tools really does help

10:15 stop 1216-now I can sit-those fast moves really tempt you to jump on them-one thing I

find useful is to set an egg time for 10 minutes and wait until then to see the nature of the 20 minute cycle

10:11 I really don't like out of band trades - they only work when the trend is flat-Which

I knew from looking at the SP9 day chart-so I was expecting a break above yesterday's highs to fail

10:08 stop 1218 - I waited to see what sort of follow through that streak had-and I knew if it

broke back below the Moon +T315 flus line, it did not have support for going higher

10:06 sold 1215 stop 1219

10:05 this is a 6 point resonant streak at 10:00

10:00 this is an out of band sell setup, so I'm watching to see if it breaks below the 20 EXMA

9:56 that move popped prices up near the upper band, so I'll wait unit the trade time to see if

this fades or not

9:54 looks like the bulls are out in force, so watching for a small pullback to buy

9:51 now getting a run to test yesterday's highs-watch the +T315 Moon flux for resistance

9:46 the MoonTide forecast is particularly jerky today-that indicates a choppy day

Trade times are 10:36, 1:30,2:50-all Eastern time-one or more may not be good setups

9:43 prices seem to be stuck on the -T045 Moon electric field flux line

9:37 The SP9 day chart shows a two day rising wedge pattern, and a flat channel, support near 1205

this tells me today is probably a modest pullback day

9:30 opening flat -after a wild week, this may be an "I'm exhausted" day

9:00 Good morning from Chaos Manor

Besides the comments made by Al, the chat room is has live

comments from other traders who sometimes share their views,

trades and tips. Below are the chat room comments from this clinic

3/11/2005 11:30:29 AM Mountain mjs:: Last times we came on J we have gone up and we cross it 13:45

3/11/2005 11:20:19 AM Mountain mjs:: My indicators show 13:36 and 13:45 as turn points if we go up look for 1213 if we go down look for 1208

3/11/2005 11:16:04 AM Mountain mjs:: thanks for the encouragement mm: This stuff is both easy and hard just depends on the day. One book I got for $0.98 was Larry Livermore's Reminiscences fo a Stock Operator. Great encouragement reading about trading and living life.He made and lost millions back in 1895-1930. A lot of his trades you can understand as Astro Trades (for unknown reason to him he shorted the market 2 days before the San Francisco earthquate in 1897 but we know he was tuned to the planet conjunctions that really caused it - many of this other trades can be explained that way he had a "feel" for the market) Also gives you appreciation for how big operators like banks etc trade and think and it hasn't changed in over 100 yrs as man has not changed nor have the planets. The longer your perspective the better off you are.

3/11/2005 10:58:18 AM Mountain mm:: mjs: thanks for your postings - I enjoy reading them

3/11/2005 9:56:53 AM Mountain wlj:: speaking of books i just received as a gift the book al has mentioned " trading in the zone " by mark douglas . there is another hard cover book with the title trading in the zone, by ari kiev ?

3/11/2005 9:45:29 AM Mountain mjs:: here's a tip on trading psychology. My better half got me a book down at the Salvation Army were we try to buy our things as we are against the big corporate enerprises and the profits really go to help people. She got me "The Journey" which is a Bible for seeking GOD. It is annotated with understandings and references etc so you can see how it is all intergrated and learn concepts some of our pea brains have a hard time grasping. Anyway if you get Trader's Block or run into a string of losses it is a great way to come back to earth and get back in the zone the Library of Congress # is 95-62351 published by Sondervan Publishing House. You might even get religion if you don't already have it. You will understand the forces we are makeing $$$ on here. Question is what are we doing to do with it?

3/11/2005 9:12:50 AM Mountain mjs:: Here's a tip on education. Superbookdeals.com (Trader's Books) has a special. They are cleaning out old stock If you buy $25 worth shipping is free. I got two boxes of books all cost me $ to $5 and it is amazing the ideas people can get published. The one I liked best was on Gann trading where you got a video and the guy shows you how on $30,000 he made $7,000 in one year with a drawdown of $10,000 and he is selling this kind of stuff. Makes you wonder about human intelligence.

3/11/2005 9:01:04 AM Mountain mjs:: I moved my M,V,R cycle 60 min and it signaled that turn to be coming at 10:48 and it arrived 10:51 unfortunately I was projecting a move up based on how my action was aligned with the curves.

3/11/2005 8:56:34 AM Mountain mjs:: here's a bit of intelligence for you cycle fans. I worked in the Division of Corporate Finance at the SEC Wash DC from 77-80. The Chief Financial Analast there (he headed all the FA at the SEC) had Brenner's Chart framed on this wall. As the ebb and flow of IOPs etc came and went he would just point to it and say "Oh! we are now here and we are going there". A real education in what experience is all about.

3/11/2005 8:45:51 AM Mountain mjs:: Hey wlj: it was an easy buy of $70 million from AIG with Merrill then doing the trading after the tie out (when we tell AIG which ones don't meet criteria). The bubble will last as long as GDP stays positive as to counter rate increases we are dropping credit criteria to keep up volume. The funny thing was one of the Due Dilligence consultants brought in his old news clips for 1986-1990 when RE and mortgage world tanked last time. All our concerns were well described in those old papers. Best estimate for ETA of RE bust is 2006-08 but it could be a wimper as it isn't the homeowner who decides it is the mortgage holder who advances the loans and from those 1980s news clips we were reminded of all the tricks people will play to keep the game going even when the writting is on the wall. It will take a maor recession and 10% unemployment till then plenty of waitresses and cab drivers want the dream of homeownership and plenty of lender are ready to accommodate them. Still we made our 25 basis points of $1.75 million for 3 days work.

3/11/2005 8:14:11 AM Mountain wlj:: mjs, you came back yesterday, two days early. does that mean the housing bubble is about to pop

3/11/2005 8:09:23 AM Mountain mjs:: the spike just before N which has show effect in pushing prices up/dn last few days one way or other. Also news came out Intel forecast better but cap on market is widening trade deficite and market concern over this

3/11/2005 7:32:51 AM Mountain mjs:: Da Monkey is trading today: Monkey see Monkey do following the Tides and cashing in on chaos. Looking for banannas today.

9:00 Eastern-System: No comments

[ Live Clinics on Friday on DaytradingForecasts.com ]