Chaos Clinic Recap

Here are Al's comments

************************************************************************************************************************

A Luny Week On Wall Street

Chaos Clinic for 8/8/2019

************************************************************************************************************************

This past week the US stock market was - in a word - luny. Last week's Chaos Clinic warned that it might be so.

These two charts show two views of what happened.

Luny comes from lunatic, which in turn comes from lunar. Folklore has long associated crazy behavior with

the Moon. During Full Moons, patients in insane asylums were observed to be very agitated, behaving erratically.

Crazy behavior in markets, especially the S&P, can be traced back to the Moon, as well. This is the basis

of the MoonTides trading methodology offered on daytradingforecasts.com

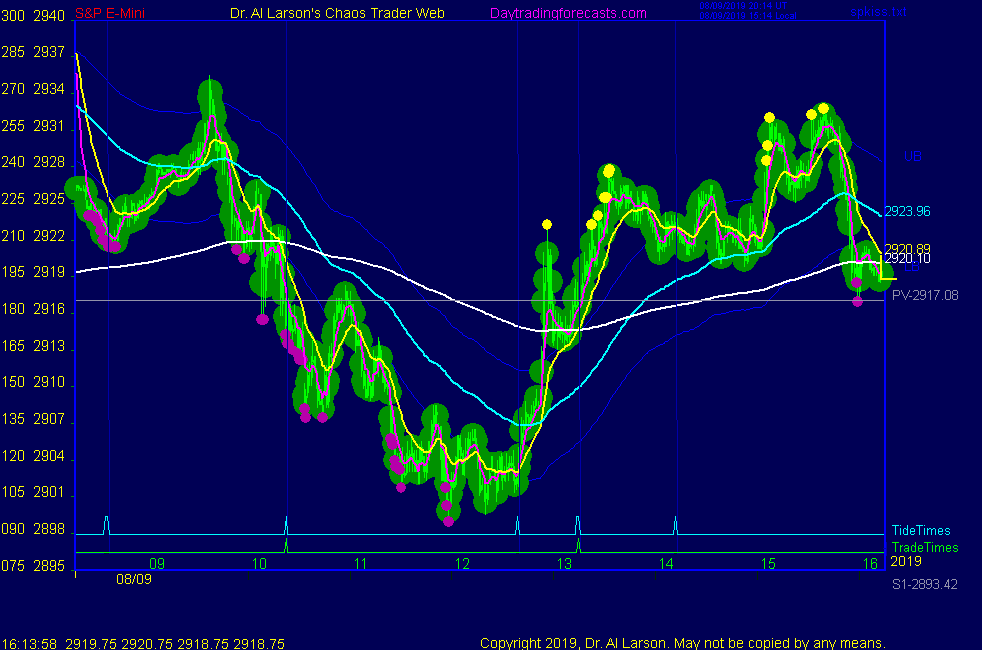

The top chart is last chart from the SPKISS page on that site. It shows the Moon electric field flux lines

for various harmonics. These flux lines are support/resistance lines. Several lines are of interest on the chart.

At line A, a down sloping seventh harmonic flux line triggered the FOMC drop. That drop bounced off a rising sixth

harmonic line at B. Then at C, a down sixth harmonic line triggered the Trump tweet drop. Following

Monday's plunge, a rising sixth harmonic flux line started a rally.

An obvious question was "How far will it rally?" The answer was in the flux lines. As it turned out

a sixth harmonic down flux line at E lined up with last week's eighth harmonic line at C.

The pair formed a top of channel resistance line. Pretty neat, eh?

Flux line software for NinjaTrader is available at EnergyFieldTrading

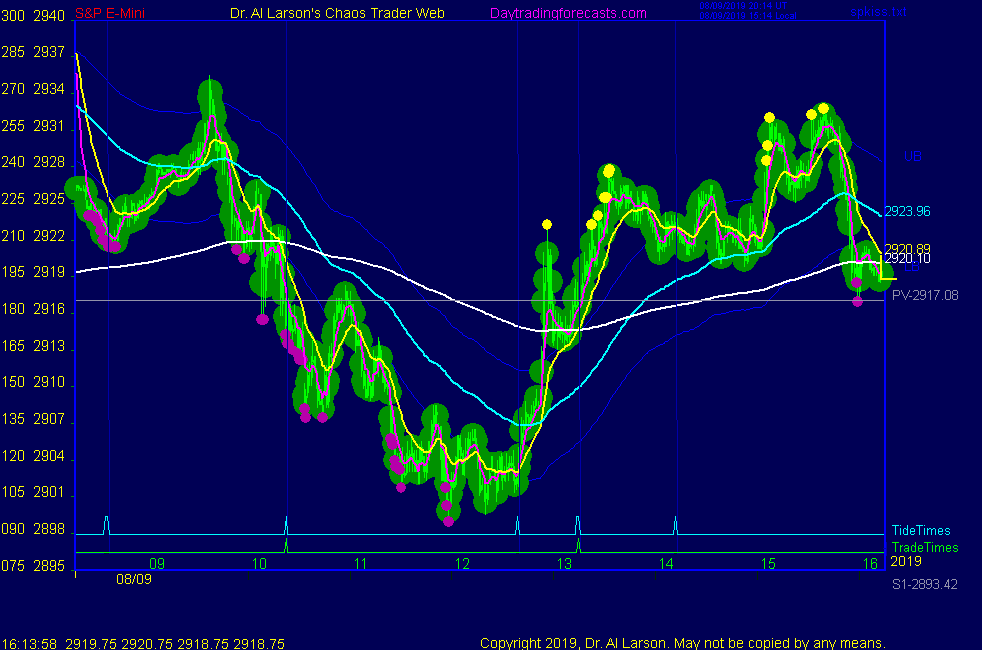

The second chart shows the Powell-Trump Dump and rebound as a move 1 and 2 of a down Chaos

Clamshell. From the high, the move 1 drop was 253.75 points. The move 2 rally was 164.75 points,

and stalled at the 24 day EXMA. A standard Fibonacci .618 retrace was 2932.5. The retrace

has the common ABC form of many corrections. One would expect selling here.

If this is indeed the end of the rebound rally, lower prices are ahead. For this to happen,

the all the EXMAs shorter than the 12 day need to turn down. Next week will tell us more.

A target of 2810 by the end of August remains viable.

For more on my work, see Moneytide.com

Besides the comments made by Al, the chat room has live

comments from other traders who sometimes share their views,

trades and tips. Below are the chat room comments from this clinic

8/9/2019 1:37:39 PM MT ****:: I will be holding short based on the range next week from the moontide harmonic grid.

8/9/2019 1:36:08 PM MT bew:: curious if anyone is going to hold short positions over the weekend?

8/9/2019 11:21:14 AM MT mj:: Market should be up for all of August making a final top in the 2nd week of September 2019. I think your call on a top is too early Al, you did the same in 1987. I think you need to look at your calculations. Find out why your 1987 call was early.

8/9/2019 11:01:45 AM MT Al****:: I'm going to call it a day- got up very early ; thanks for coming

see you next week. Take some courses. Have a good weekend everyone

8/9/2019 10:58:43 AM MT Al****:: just over 17 points; wanted to carry over weekend but this is fine.

8/9/2019 10:57:28 AM MT Ted:: Thanks for the comments everyone.

8/9/2019 10:55:35 AM MT Al****:: stopped out.

8/9/2019 10:43:20 AM MT Al****:: lowered my swing trade stop to 2913.5

8/9/2019 10:40:22 AM MT Al****:: Thanks for pointing that out TG.

8/9/2019 10:36:51 AM MT TG****:: Good afternoon, high near the open was 45 minutes before the tide time. Late morning low was 41 minutes before the next tide time. That's a precise and consistent move.

8/9/2019 10:24:49 AM MT Al****:: The third chart on the SPKISS page has bars colored by the 20 minute EXMA crossing the 110. Note that it signaled a sell

early, and the EXMAs are steady down

8/9/2019 10:01:12 AM MT Al****:: the Flash Boys sold the rally to the pivot 2917; S4=2823 possible

8/9/2019 9:58:34 AM MT Al****:: interesting about the currencies ; lots to worry about: trade wars, profits, slowing global economy, and Brexit

and we are not even to October yet

8/9/2019 9:34:43 AM MT Al****:: stop 2920

8/9/2019 9:31:50 AM MT Al****:: turning 6 day down

8/9/2019 9:12:30 AM MT gon:: Thanks Al!

8/9/2019 9:09:11 AM MT Al****:: turning the 12 day EXMA down

8/9/2019 8:43:38 AM MT Al****:: just did an ABC type target calculation: about 2690

8/9/2019 8:34:53 AM MT gon:: Technically I'm on holliday, the whole familly is taking a nap, and I'm here monitoring positions...

8/9/2019 8:34:01 AM MT Al****:: moved my stop to 2928; holing as a swing trade

8/9/2019 8:33:12 AM MT gon:: Monthly charts on JPY pairs are at the border of a huge multi-year support. Beneath is empty space. Most young traders and robots never saw these pairs quoting in these lower price zones. Who knows what can happen.

8/9/2019 8:10:52 AM MT Al****:: interesting. I've never done pairs or JPY

8/9/2019 7:58:28 AM MT gon:: I've been selling yen-quoted pairs durig July, and positions are well in profit. I found these pairs don't have an up moving bias like the Dow or the S&P which have strong rallies during bear markets. Besides JPY can extend a lot in panic moments.

8/9/2019 7:58:18 AM MT Al****:: that pop up was mostly the green +Tide

8/9/2019 7:55:56 AM MT Al****:: I did sell 2930.834

8/9/2019 7:49:39 AM MT Al****:: Thanks GON

8/9/2019 7:49:18 AM MT Al****:: got selling at the .618 = 2932.5

8/9/2019 7:48:30 AM MT gon:: Hi Al! Article published: https://www.fxstreet.com/analysis/a-luny-week-on-wall-street-201908091347

8/9/2019 4:25:18 AM MT Al****:: GM all-good luck today.

Chaos Clinic is posted on AUX page.

9:00 Eastern-System: No comments

[ Live Clinics on Friday on DaytradingForecasts.com ]