Chaos Clinic Recap

Here are Al's comments

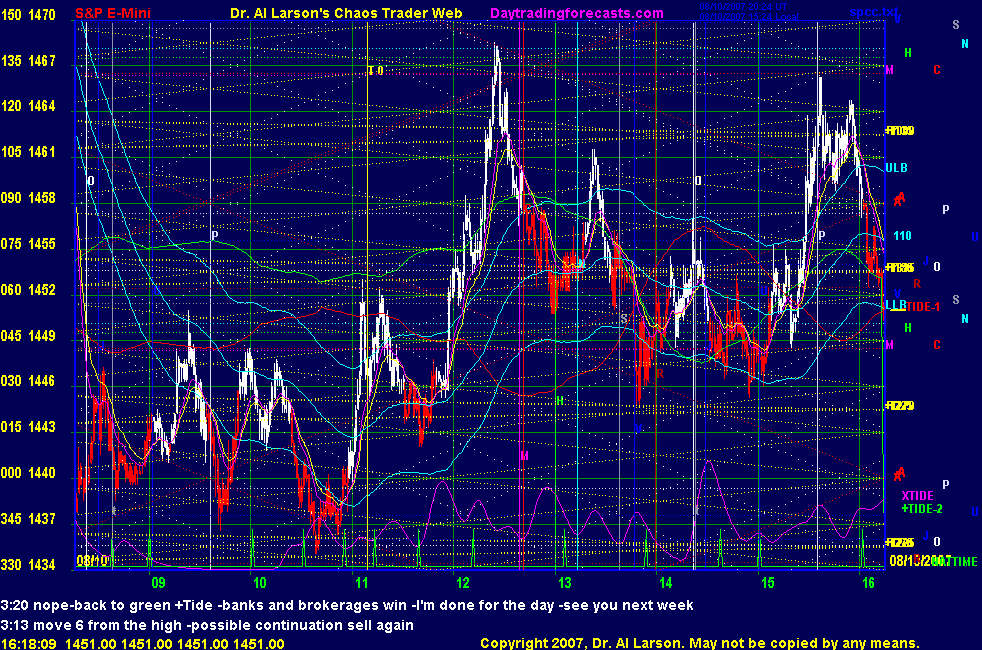

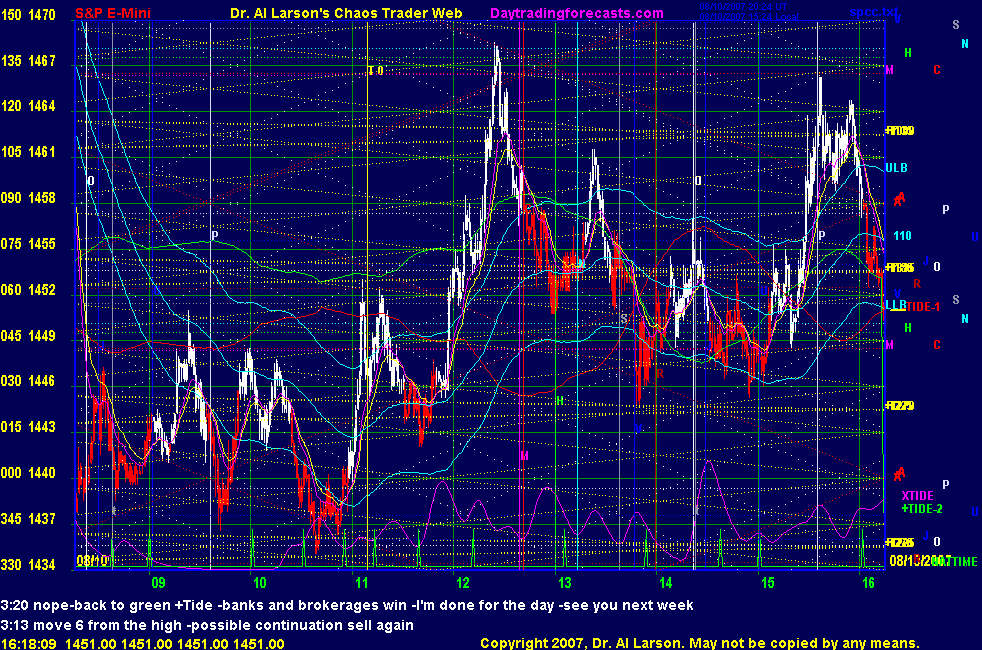

3:20 nope-back to green +Tide -banks and brokerages win -I'm done for the day -see you next week

3:13 move 6 from the high -possible continuation sell again

3:06 out +1

getting about 6 points of noise

3:00 stop 1452 - at a 3 point quantum above the 110

2:55 have inverted to the red -Tide

2:50 stop not hit - cant'go up, so late drop is possible

2:39 stop to 54 -top of the big candle at the break

2:36 stop 56 to normal 3 point position

2:28 resold 53 stop 58 at trade time; also move 4 of 7 down from the high; two candlestick dojis, and cont. sell

2:23 1451 is on the 7th harmonic of the circle -if we get 7 points below it we should drop easily

2:21 aborting -2 -not moving

2:11 resold 51 stop 56 for now

2:04 another top wick at 1453.25 , so that is resistance; if I get another sell opportunity, stop will be 1453.5

2:00 stopped +2 - OK, can resell

1:55 my advice to experienced traders was to triple our normal numbers on a good move-stop trail by 9, take 15 or 27

if we get rolling I may do that

1:53 stop 1451 -locking 2 - will try to hold into close

1:51 stop 1452

1:47 they just did; stop 53

1:45 49.75 is a breakdown price where automated trading systems will sell

1:42 stop 57 above top wick 3 candles back

1:32 sold 53 stop 59 for now -I got that stop off the top wick on the last 3 minute candle

1:30 now watching for the third trade - the banks an brokerage houses would lik to hold the market up into the close

can they do it?

1:27 out for 0 - nothing there - note how I played defense

1:23 stop 57 and will take 5 if offered

1:22 stop 56

1:20 continuation buy 57 stop 54

1:15 trading range has now narrowed - so risk is reduced - still 50.75 last minor low to 56.70 last minor high is 5.75 points

1:12 top wick on 3 minute candlesticks; 56.50 is resistance - good place for as stop

1:11 watching a rising trendline under the lows - TA guys will sell the break of it

1:07 watching for a sell opportunity - parked back at the 110

1:03 still watching-clear now that the bears have regained control

12:51 the whole chart shows a fireball with one forth visible with center at left of chart and about 1467

12:48 with a bit of luck we will get a sell setup within the next half hour or so

12:41 position traders sold on that rally ; I'm still finding it hard to find safe day trades , so being patient

coming to second trade time

12:36 high set by next week's Harmonic Convergence

12:33 hit Sun flux as well - Sun is at 13:00 , and coming into green +Tide high-watching for a rollover

12:27 popped up to the Mercury/Chiron flux as come to their timelines

12:10 high on Pluto flux -may be it

11:58 testing the highs again-the 110 is tracking the green +Tide

11:47 during a dull congestion is also a good time to shop for options, since the premium drops a bit as the volatility gets lower

11:38 back to the middle - if I can't collect money, I try to collect information - that Mars/Jup/Node pattern

becomes exact on Aug 19 (Mars/Node) and Aug 23 (Mars/Jupiter) - the first is about 60 days from the June high

11:29 it also tells me that Mars(war) coming into opposing Jupiter(business) and squaring the Node(soul) is probably bearish, and high energy

11:25 low on Node, high Mars/Moon tells me the coming eclipses will be resonant events, because Mars is

harmonic to the eclipse cycle.

11:14 high was on Mars/Moon flux - Mars opposes Moon in the S&P natal chart

Mars is also currently squaring Saturn/Neptune

11:09 exact 18 point 90 degree move on the Moon timeline - clearly shows the Moon is hot

11:03 support was on Node and Moon flux - still in a trading range

10:58 out for 0 - OK - my focus is on safe trades, and that was a late entry

10:50 stop at 41 has held for now

10:38 stop 41 -now can have some fun

10:34 stop 43 -above the 20 EXMA

10:33 my origanal entry was good, but I flinched - elephants dancing scare me :)

10:29 I missed a good reentry whild I was typing the Clinic comment

10:27 sold 41 stop 46

10:25 stuck between the Moon flux lines -back to watching and waiting

10:15 aborting -1.25-don't like it

10:13 stop 48.5-at top of wicks

10:09 what has been working is to use the 110 as a stop guide and watch the candle wicks

10:06 I have been finding it hard to mechanially trail a 3 point stop in this market, so I have slowed down my stop moving

10:04 sold 46 stop 49

10:00 up to 110 - may get a continuation sell that we can use a 3 point stop on

9:50 now have set a trading range between Uranus low and Neptune high - first trade time of 10:44 may be a pass

if we stay in the range

9:41 we are getting 5 point 3 minute bars - too big to be trading safely with 3 point stops - so watching and waiting

9:21 If you look at the Closing Wheel of Fortune for Wednesday and Thursday you see the highs were set by

Uranus, Neptune, and Pluto - all long term cycles. Uranus opposes Pluto in the NYSE natal chart. Subtle clues

about the nature of events.

This morning's spike high was on Mercury/Chiron flux- Chiron squares Saturn opposing Neptune in the NYSE chart.

Mercury squares Saturn/Pluto in the NYSE chart. All this tells me that whatever is going on has more to do with

the NYSE than a particular stock or index.

9:10 Today's mood is starting out as one of shock - may trade flat for several hours

8:51 Trading down at 1440 - square Pluto, who set yesterday's high

I have changed the Breaking News link to point to CNN Money - they have a good video on the

U.S. subprime mortgage crisis

9:00 Good morning from Chaos Manor

Besides the comments made by Al, the chat room is has live

comments from other traders who sometimes share their views,

trades and tips. Below are the chat room comments from this clinic

8/10/2007 1:45:14 PM Mountain TG:: I just started reading a book about traders and successful strategies called "Way of the Turtle" by Curtis Faith. His example of a trending and volatile market is a CCS the way Al sketches them out free hand. Shows 7 moves in his example not E-wave 5. Thought that was kind of cool.

8/10/2007 1:32:01 PM Mountain TG:: There's definitely a fine balance between patience and stubbornness. Yesterday, I had a few small gains, kept getting whipsawed. Late so selloff setting up and got in too far from 110 and lost days profit. I usually don't take trades after 3:30 but took one last one at about 5 minutes before 4 and rode it down for 8 pts. I don't know if that was patience or stubbornness.

8/10/2007 1:23:54 PM Mountain Al:: nice job TG - see that wee got hexed

8/10/2007 1:21:48 PM Mountain TG:: Right Al, usually 6 pts of noise, sometimes 10 pts in last 2 days. Anyway, was starting to find support on a key CTME up streak so decided to lock in a few pts just above last few wicks. Also had 7 nice moves in 20 exma with lower lows but price was just hanging around and not following new lows in 20 exma.

8/10/2007 1:09:51 PM Mountain TG:: Locked in 4 pts. Will resell if tanks here

8/10/2007 12:55:08 PM Mountain TG:: Ok stop to 54.

8/10/2007 12:45:28 PM Mountain DBJ:: Out flat, again

8/10/2007 12:33:11 PM Mountain TG:: raising stop to 58.5. Last two days made 16 pts and would have been a lot more if not for wild whipsaws. Will give it the room it needs and if it takes me out for 5 here so be it.

8/10/2007 12:31:59 PM Mountain DBJ:: Resold 52, "once again into the breach"

8/10/2007 12:26:18 PM Mountain rgh:: today moon is void of course from 08:57 am to 8/11 06:42 am

8/10/2007 12:24:01 PM Mountain DBJ:: Out -2

8/10/2007 12:13:47 PM Mountain DBJ:: Resold 53

8/10/2007 12:12:56 PM Mountain TG:: sold 53.5 stop 57.5

8/10/2007 12:03:09 PM Mountain DBJ:: Out flat

8/10/2007 11:52:30 AM Mountain DBJ:: Placed a position sell at 52 on the thought that it might be a rough weekend. Stop 52

8/10/2007 10:25:17 AM Mountain gdl:: trying to get long. no pullbacks

8/10/2007 9:08:11 AM Mountain TG:: Looks like move 4 underway on 3-day fractal.

8/10/2007 8:47:04 AM Mountain gdl:: any shorts?

8/10/2007 7:37:26 AM Mountain mm:: gm all - hope for good volatility for the clinic

9:00 Eastern-System: No comments

[ Live Clinics on Friday on DaytradingForecasts.com ]