Chaos Clinic Recap

Here are Al's comments

************************************************************************************************************************

S&P Stalls at Old Highs

Chaos Clinic for 9/20/2019

************************************************************************************************************************

Last week I wondered if the S&P would make another Powell-Trump-Dump (PTD) top this week.

While the details differ from the past PTD, the evidence is that the S&P has topped.

The top chart shows the S&P futures since early June. Prices have rallied four times to the

3025 level, which is 25 squared. Squares are often key support and resistance levels.

Gann's Rule of Four states that when a price level has been tested four times, a volatile move usually follows.

It does not say which way the move will go. The top chart has a rainbow of EXMAs. The shorter two,

the 1.5 and 3 day, are lower than they were a week ago. They need to turn clearly down, as do the

6, 12, and 24 day. Doing so would confirm a new downtrend. The ZD32 chart is forecasting a downtrend

into the first week of November.

When one is expecting a major turn, one can watch the intraday charts on

daytradingforecasts.com

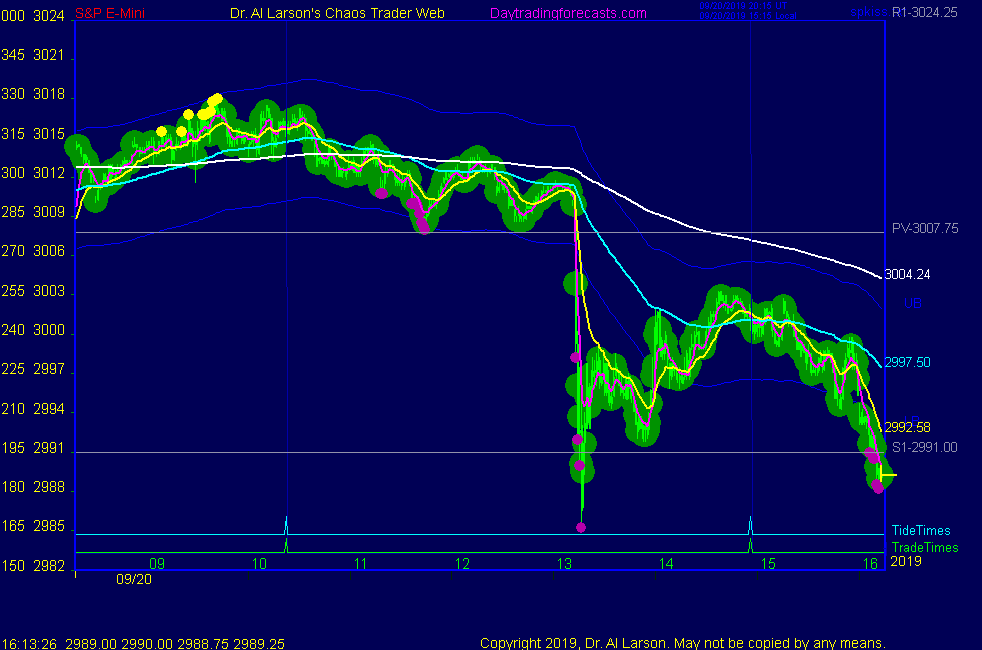

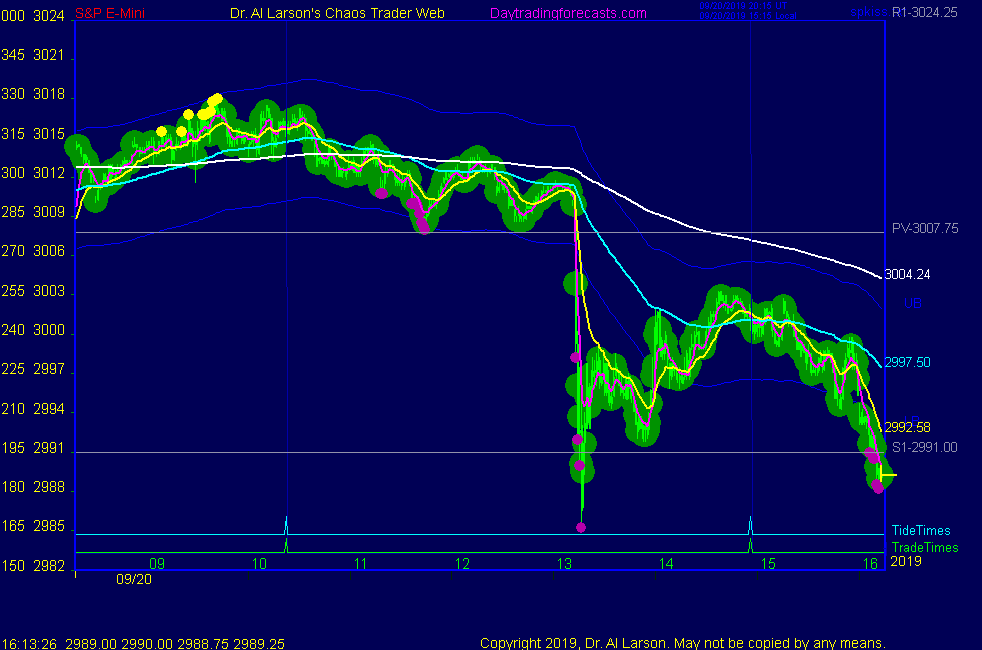

The second chart shows today's eMini S&P using 3 minute bars, with EXMAs of 6, 20, 110, and 440 minutes.

It also shows three MoonTide trade times near 9:50, 11:16, and 13:52 Eastern. The trade guide lines are to

trade in the direction of the cyan 110 minute EXMA, either buying the dips or selling the peaks in the yellow 20 minute

EXMA. For example, the first trade time suggested buying the dip near 3018. Target rules are to normally go

for 5 or 9 points. In this case, noting that the Flash Boy computers would probably sell the R1 level at 3022.5,

a cover at 4 points profit would have been prudent.

Given the larger context of the possible PTD, the second trade time did not look like a good buy setup, especially

give that R1 was proven resistance. MoonTide trade times are not specific "must trade" times,

but the center of a trade window of about 45 minutes either way. So in this case, I did nothing at the trade time,

but waited and studied what was happening. When I saw the sharp peak near 11:36 I noted how it fell two

ticks short of the important 55x55=3025 level. Then I watched the next rally to see if it was a lower high.

When I noted bearish 3 minute candles and a sell setup on the 6/20 EXMA pair, I sold at 3021.25.

Shortly after my sell, the cyan 110 EXMA turned down, followed by crossings of the 6 and 20 minute EXMAs.

The new minor lows confirmed a change in trend. The sharp vertical move suggested I had made a good trade entry.

About twenty minutes after my entry, I had a spooky experience. I heard a whisper in my head that said,

"Something is in the wind." I've had many intuitive insights, but never a verbal whisper. I took a break and talked to my

news junky wife. She told me that a news item about a whistle blower report on a Trump-Putin conversation was trending.

OK, that could be the T part of a possible Powell-Trump-Dump. Or I could simply be crazy. Time will tell.

Given the larger context of a possible major top, I decided to let the trade run past the third trade time,

carefully lowering my stops. My interest was in the behavior of the EXMAs. Specifically, I wanted to see

the 440 minute EXMA turn down, and prices to trade below it. Both happened by the close.

At that point a day trade cover was good for about 13 points. A swing trade stop at 3019 insures at

least a small profit on the trade. A good strategy is to use multiple contracts, taking half off at the

end of the day and letting half run.

Major turns take time. If this is a major turn, the EXMAs on the top chart have to turn down. So the next

week is important. The autumnal equinox is on Monday. The equinoxes and solstices are often major

turns in many markets. And of course, one tweet could lead to a chaotic break.

For more on my work, see Moneytide.com

Besides the comments made by Al, the chat room has live

comments from other traders who sometimes share their views,

trades and tips. Below are the chat room comments from this clinic

9/20/2019 12:42:53 PM MT Al****:: I'm going to quit for the day. Eight hours on the screen is enough. The rest of the day is left as an exercised for the student. Holding my swing trade stop 3019 until Monday. Thanks for coming. See you next week. Take some courses.

9/20/2019 12:38:53 PM MT Al****:: day trade stopped for +12

9/20/2019 12:31:34 PM MT Al****:: after a break, the loner EXMAs will go "lock limit", and draw straight lines. You can sketch extensions to them to get an idea of where price may go . On my spliced 8 hour session chart, the 440 minute EXMA extended hits about 2976 by Monday close

9/20/2019 12:19:57 PM MT Al****:: a day trade stop could go to 3003, locking 12

9/20/2019 12:16:45 PM MT Al****:: here I watch my 110 and 220 minute EXMAs to see which stops the rallies; so far looks like the 110

9/20/2019 12:09:41 PM MT Al****:: OK. It was in the energy field first; just more indication of the instability in the market

9/20/2019 12:01:43 PM MT BOG****:: News was china cut short meeting in montana to check out farms

9/20/2019 12:01:28 PM MT Al****:: no problem-I fixed it

9/20/2019 12:00:35 PM MT BOG****:: Sorry Dr. Al, my computer got stuck. Kept pressing submit either that or your website was out.

9/20/2019 11:57:41 AM MT BOG****:: Thanks Dr. Al, I never read about the double frequency

9/20/2019 11:52:31 AM MT Al****:: but it does look like the rate cut just underscored an unstable market condition

9/20/2019 11:51:31 AM MT Al****:: I'm not seeing any particular news event here so think it is just the market astrophysics ;

9/20/2019 11:45:08 AM MT Al****:: earlier I said: "could change after the vertical line near 12:20 on the Secret->esNat72 chart " ; sometimes I'm right

9/20/2019 11:34:41 AM MT Al****:: if you look closely at the 20 minute EXMA just before the drop,

you see 2 cycles, the second half the time length of the first. That is frequency doubling, a precursor to chaos. It is covered in the Cash in On Chaos course.

9/20/2019 11:31:18 AM MT Al****:: looks like a lot of Flash Boy computers sold the pivot all at once

9/20/2019 11:21:22 AM MT Al****:: thanks srt;

9/20/2019 11:20:06 AM MT Al****:: drop came right at solar noon. Now I'd lower stops to 3008, just above the pivot

9/20/2019 11:19:25 AM MT srt:: Wow Al you made my weekend with this sell trade thank a lot

9/20/2019 11:16:48 AM MT Al****:: patience BOG :)

9/20/2019 11:14:41 AM MT Al****:: OK, there is the "Something is in the air."

9/20/2019 11:01:12 AM MT BOG****:: I feel like there is not much down side today, Maybe we bottom Tue/Wed and go higher to end of next week. The big pull back coming in early October.

9/20/2019 10:58:40 AM MT ska:: YES VERIICAL WHITE LINE IS secret How about significance of that line ?

9/20/2019 10:55:59 AM MT Al****:: not moving that fast; last minor swing high 3013.75; a good stop now would be 3014, locking one tick

9/20/2019 10:46:11 AM MT Al****:: I have placed a chart in the Certified Chaos Trader's Room. That room is open

to graduates of my 4 main courses. See http://moneytide.com -> Courses for details.

eMylar Fractal of Pi overlays help you be patient, since they show you future potential moves.

The best bargain in my courses is to take the Cash In On Chaos and Fractal of Pi courses and

learn to use the FOP overlay. Then take Chaos Trading Made Easy, and finish with Face Of God.

9/20/2019 10:39:39 AM MT Al****:: getting near the vertical line in the Secret->esNat72; also in Secret->Daniel chart

9/20/2019 10:32:08 AM MT Al****:: another 20/110 continuation

9/20/2019 10:09:49 AM MT Al****:: pretty good bounce from near the pivot

440 EXMA at 3013.15 so 3015 break even stop looks good

9/20/2019 9:42:55 AM MT Al****:: given the climate of a possible major turn, I'd let the day trade run

9/20/2019 9:39:56 AM MT Al****:: looks like could get a good drop-day trade stop to 3015 break even

9/20/2019 9:20:02 AM MT Al****:: I like the little bit of follow through

9/20/2019 9:16:12 AM MT Al****:: a reasonable stop on the MoonTide day trde would be 3017.5, one tick above the last high

9/20/2019 8:51:51 AM MT Al****:: did get a 20/110 sell signal on that trade time near 3015

9/20/2019 8:49:30 AM MT Al****:: Thanks GON.

9/20/2019 8:45:59 AM MT gon:: Hi evryone! Al, your article is published as always. Since it includes a position, we will add it to our Positioning Table, so you get more exposure.

9/20/2019 8:35:32 AM MT Al****:: my guess is that it will follow the green +Tide, but may not have much juice

9/20/2019 8:31:33 AM MT Al****:: first MoonTide trade not showing me a good trade setup

9/20/2019 8:22:05 AM MT TG****:: Good morning. No I don't know anyone either and not sure averaging to a seemingly better price is a good way to be trading. It can work most of the time but when it doesn't its disastrous. Maybe ok to do right up to a specific line in the sand stop.

9/20/2019 8:17:35 AM MT Al****:: don't know anyone trading micro eMinis-anyone?

9/20/2019 8:16:05 AM MT Al****:: rally stopped 2 ticks below 3018 ; then got selling; 3019 stop OK so far

9/20/2019 8:08:52 AM MT Al****:: the 3015 price is 135 degrees, being set by the equinox.

Equinox's are 4th harmonic point in the cycle of the year.

135 is an 8th harmonic price.

9/20/2019 8:08:31 AM MT jvj****:: I am experimenting with trading the micro E-mini contracts.

Can average up or down several times with less risk than in E-mini's. Do you know if anyone on your site is trading them?

9/20/2019 8:03:44 AM MT Al****:: so far choppy "quad twitching" -could change after the vertical line near 12:20 on the Secret->esNat72 chart

9/20/2019 8:01:00 AM MT Al****:: I used that yellow level to pick my 3019 swing trade stop

so far so good

9/20/2019 7:49:22 AM MT Al****:: Amen to that. Meanwhile I note that the early rally hit the yellow vibration level on Secret->esNat360

It is also about a Fib .618 retrace of yesterday's normal session range.

9/20/2019 7:24:39 AM MT jvj****:: Have also noticed that same thing. Since all option, stock, and future positions have to settle at the same net value, the prices often peg during the day. However, I also note on some witching days there can be violent moves also. I just don't try to outguess the big boys!

9/20/2019 7:12:38 AM MT Al****:: Thanks. What I've noticed is that the S&P can often just make minor moves all day on quad withing days.

9/20/2019 7:09:43 AM MT jvj****:: I don't worry too much about option expiration anymore, as I don't usually trade the expiration cycle. All of my option positions have been either taken off or rolled to the October expiration. By next week I will be starting to roll existing positions into November.

9/20/2019 7:01:56 AM MT Al****:: I think I am, jvj. Thanks for asking. I was just thinking about you with your option experience. Today is quad witching day. What

are your thoughts on it?

9/20/2019 6:56:16 AM MT jvj****:: Good Morning Everyone, Al, Hope you're fully recovered.

9/20/2019 5:52:08 AM MT Al****:: GM all. Good luck today. The Chaos Clinic is posted on the AUX page.

9/20/2019 5:04:58 AM MT ska:: gm

9:00 Eastern-System: No comments

[ Live Clinics on Friday on DaytradingForecasts.com ]